AHI People Risk Management Cheat Sheet + Checklist

Risk management explained for your customers

Whether your customers are sole traders, a builder with a team of labourers, or the CEO of a multinational corporation, there is one common factor that will keep you up at night – risk. Businesses both small and large dedicate significant resources, time and budget to dealing with their risks.

Why? Because how your customers manage risk can mean the difference between having a thriving and profitable business and going under. In some circumstances, it can also be the difference between life, disability and death.

Mitigating and managing risks for small to medium businesses can be significantly more difficult, given the plethora of responsibilities individuals in these businesses carry. The team at AHI thought we’d help you out by doing some of the leg work, and provide a high level summary of people risk management; and for those that are particularly time-poor, we’ve developed a practical risk management checklist.

How do you identify your business risk |

|

|

Each business is unique, as is each business owner or manager’s risk appetite, so it’s important to consider potential threats to your business with this in mind. Below we’ve collated a list of some of the potential risk areas for you to consider:

|

|

Risk Management

Risk management is all about identifying, evaluating and monitoring risks, and most importantly, developing policies, procedures and governance to help avoid or minimise the impact.

We really like this simple five step approach to risk management:

- Identify your risks

- Analyse the likelihood and impact of risks on your business

- Evaluate: CARVER management approach

- Mitigate: Develop business continuity plans, including prevention strategies, response procedures and contingency plans (e.g. insurance)

- Monitor: risks rarely remain stable, you should continually be running your risks through steps 2-4

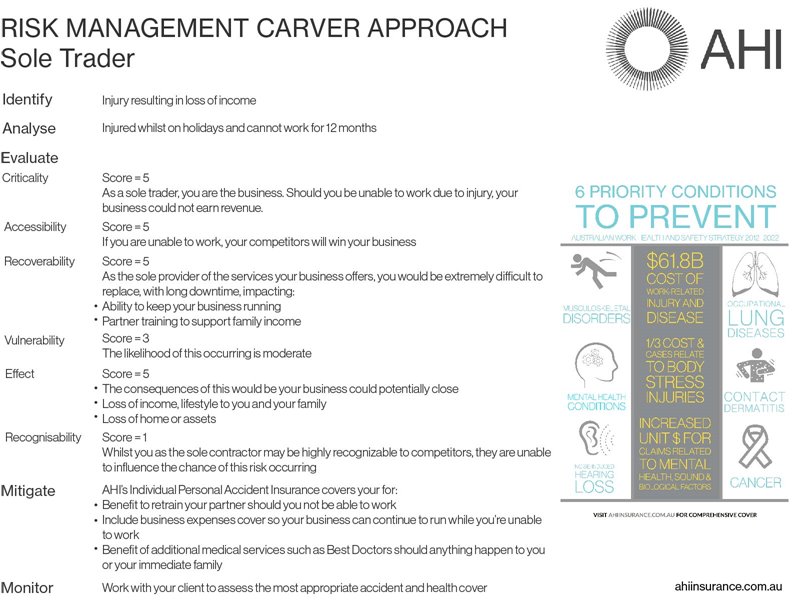

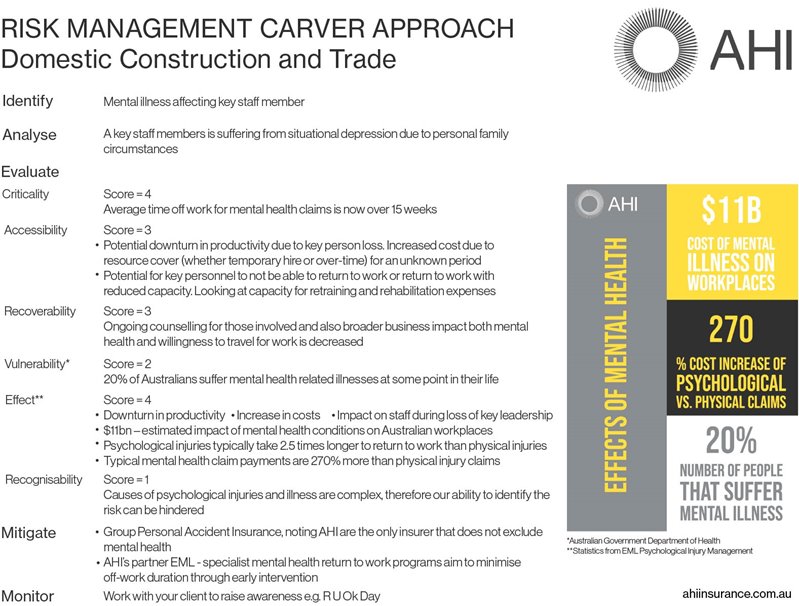

We’ve developed some examples below to help you work through risk evaluation and mitigation based on claims we’ve seen. Whether it be at home, at work or abroad, where the risk could have been avoided or impact minimised with appropriate risk mitigation strategies before, during and after such things occur.

Risk Management Checklist

- Risk identification, assessment and monitoring

- Business continuity planning

- Ensure your customers insurance cover is up-to-date and meeting their business needs

- Prevention programs

- Emergency response management

- Legal / Governance review

Click to download the examples below: